Omnichannel sales & service

Asseco Advisory Banking Platform

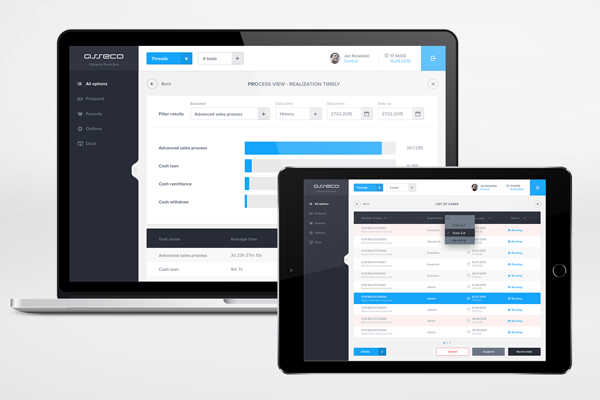

Asseco Advisory Banking Platform (Asseco ABP) is a universal IT system dedicated to employees of banks. It enables integrating all the necessary functionalities of various IT systems, which are needed to provide services to demanding customers.

Based on an omnichannel architecture, Asseco ABP enables mapping the workflow of complex business processes, which are performed with the help of multiple distributed IT systems, into a single versatile user interface. The system offers the access to innovative mini-applications, which allow for customizing the platform to employees' individual needs. With the use of the state-of-the-art technology, Asseco ABP improves the customer service quality and is a key element in digitizing banking facilities and building their competitive advantage.

Visit dedicated Asseco ABPwebsite: http://abp.asseco.com/

Key functionalities

Process management

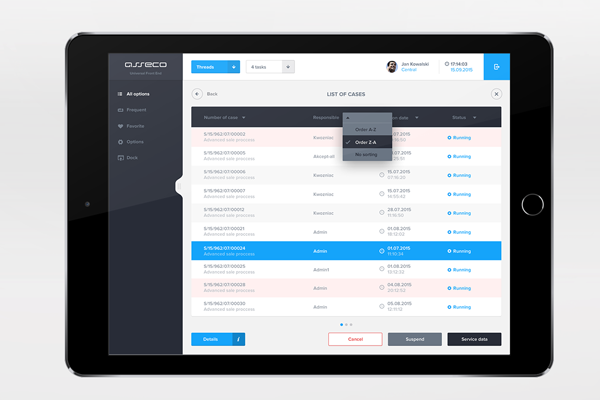

- The integrated workflow engine enables a bank to define any business process

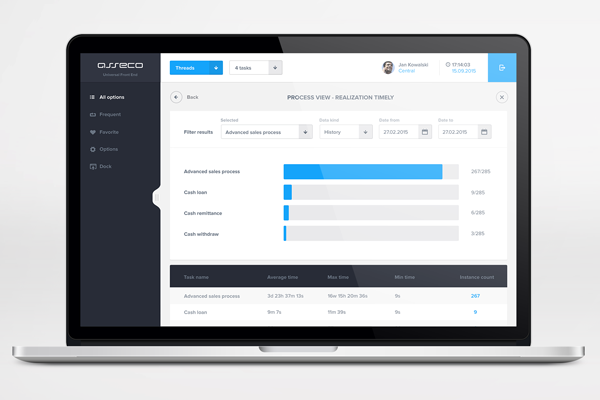

Process monitoring

- Analyzing the efficiency of employees and teams

- Active process management with the help of reporting tools

Work context

- Effective access to data (support for working with several products / customers concurrently)

- Dynamic menu of system options corresponding to the active client context / business process (e.g. conducting a sales conversation)

One user interface

- The user desktop integrates the functionality of multiple IT systems into a single platform

- Easy searching for information from all the integrated systems

Adaptive user desktop

- The user desktop automatically adapts its appearance and interaction to the currently used device

Making use of mobile device functions

- Ability to take advantage of built-in tablet device functions (GPS, camera) in business processes

Business benefits

Omnichannel architectureThe system provides full support for the omnichannel approach to selling products and services. | Improved customer experienceSmooth and efficient customer service achieved by integrating the functionality of multiple IT systems into a single coherent desktop. |

Mitigation of operational riskEnsuring consistency of data across all systems integrated with the platform. | Reduction of user training costsAchievement of cost savings by implementing or modifying business processes in just one user desktop instead of multiple systems. |

Faster time-to-market for changesShortening the time required to upgrade any business processes (launching of new banking products and services, optimizing the existing operating processes). |

Contact

If you have questions or you want to see the entire solutions in the Banking sector, send inquiry. We will contact you within 24 hours.